- HOME

- 国際税務に関する知っておきたいこと

- 恒久的施設(PE)と国内源泉所得とは?

- What is Permanent establishment and Domestic source income?

Domestic source income (PE) and permanent establishment

Foreign companies have a choice when they advance to Japan (corporate, branch, representative office).

This is determined by corporate structure or the policy of the head office, but it is important to understand the tax treatment of the choice is needed for each.

With regard to corporate taxation in Japan, the tax worldwide income as a domestic corporation if a corporation, the tax on domestic source income as a foreign corporation if branch, and no taxation facility if the representative office.

However, if it is allowed to travel a long period of time the employee is not provided the branch, and sales activities using one room hotel as an alternative to the office, though it is the same as if you had established a branch, but not been taxed in Japan.

Do you think it is strange?

In the Corporate Tax Law, allowance of this issue has been taken.

Rather than the form, classified by the criteria of whether or not "permanent establishment (PE)", so one room of the hotel also corresponds to the permanent establishment.

It is also possible to avoid taxation in Japan by at a representative of the Japanese, to the business in Japan is also an agent and included in the concept of PE.

In other words, taxation in business income "permanent establishment (PE)" and the concept that includes the plants of functional sites and physical, is that "without taxation" permanent establishment unless (PE). '" It becomes the principles of Taxation on corporation incomes.

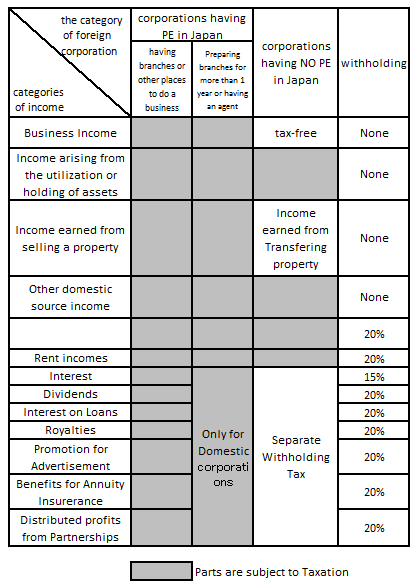

For reference, I have listed below the tables in the "Summary of withholding" Internal Revenue Service booklet is distributed. It is said that understanding of the foreign corporation tax is all right if one knows the point of view of this table.

If company earns a "domestic source income" in Japan, a foreign corporation is taxed in Japan.

And, (withholding and declaration to the tax office) taxation in Japan is determined by a combination of "Types of domestic source income" and "form of permanent establishment" of the foreign corporation.

In this table "yellow" part, it indicates that you need to pay the corporate tax foreign corporation is declared to the tax office, the rightmost column of the table shows the presence or absence of withholding.

The point here, will be to provide a thorough understanding of the concept of "form of permanent establishment" and "kind of domestic source income".

Please contact our office for direct consultation on "domestic source income", or on "permanent establishment".

"International Tax Introduction to Easy-to-Understand" [Third Edition] (2012, Yuhikaku Sensho) [References] Miki Yoshikazu Maeda Kenji

For further information, please see the links below!

|

Services

|

Why Us?

Voices

Acheivements |